Rental Equipment Excel Financial Model

Original price was: $125.$95Current price is: $95.

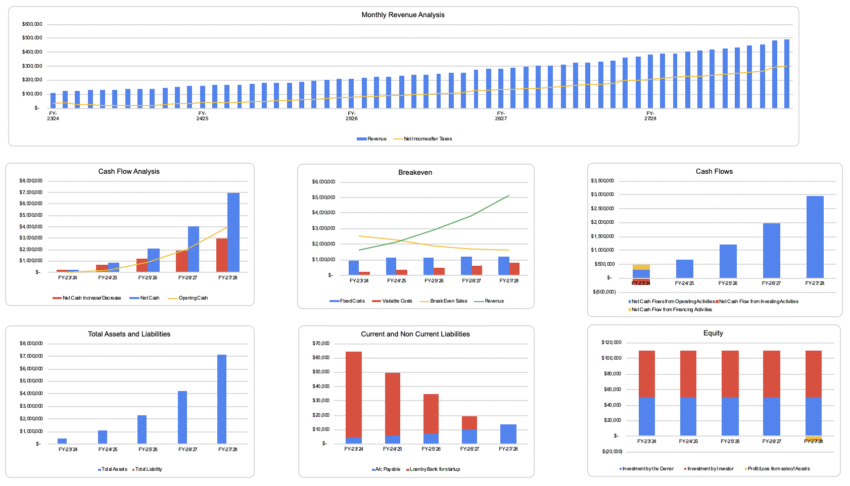

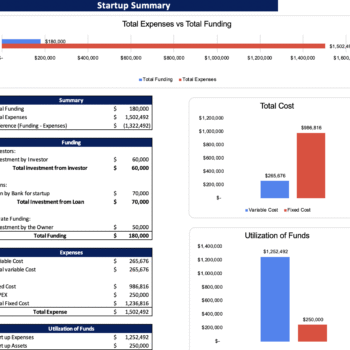

The Financial Analysts at Oak Business Consultant have created this dynamic Rental Equipment Excel Financial Model Template for your financial planning needs. The model has a 5-year financial projection plan to track steady growth and profitability. It can also estimate ongoing operating expenses, monthly sales revenue, startup investment requirements, and inventory.

Frequently Bought Together

- Description

- Reviews (1)

Description

Rental Equipment Excel Financial Model: Overview

The Rental Equipment Excel Financial Model is a versatile tool designed to streamline financial decision making for equipment rental businesses. From small scale rental enterprises to large operations, this model serves as a dynamic compass, offering insights that drive strategic planning and foster financial health.

Key Features of the Model

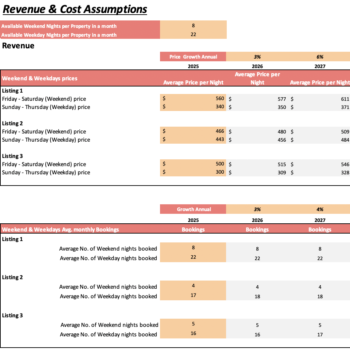

Revenue Projections

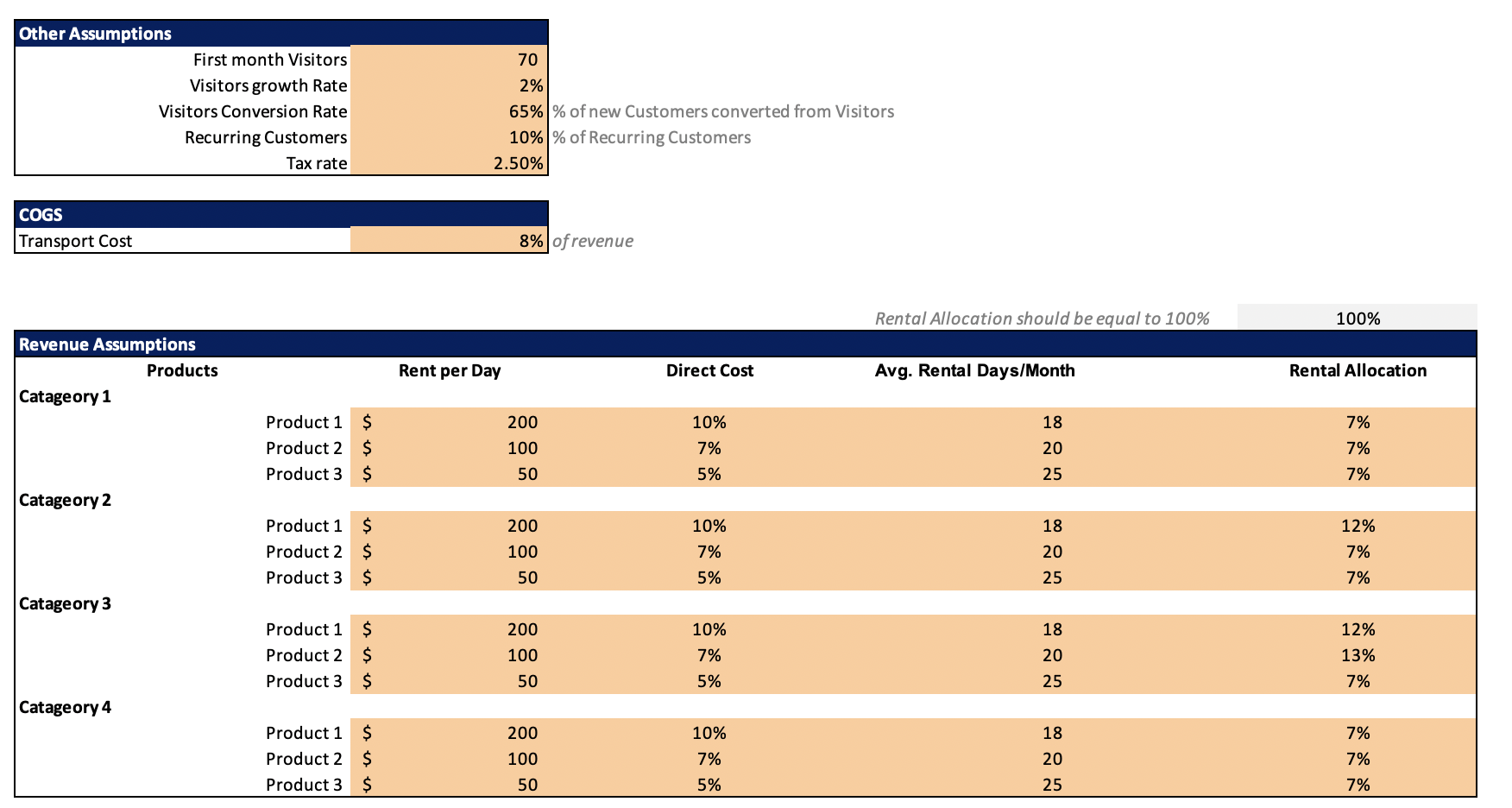

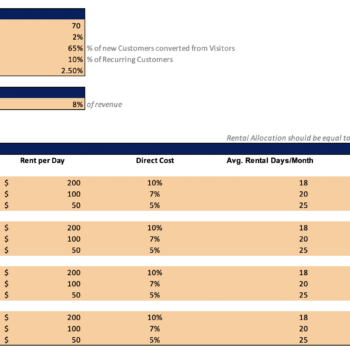

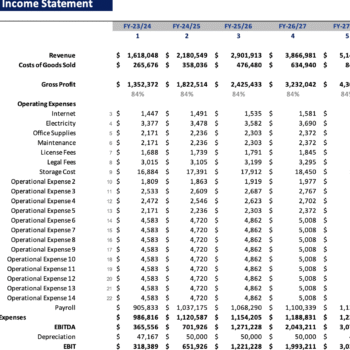

- Sales Forecasting: Project revenue based on equipment availability, daily rental rates, average rental duration, and monthly utilization rates.

- Revenue by Product Category: Segment income across equipment types such as Heavy Machinery, Power Tools, Lifting Equipment, and Seasonal Rentals to identify top-performing assets.

- Competitive Advantages: Highlight features like real-time booking, maintenance tracking, wide inventory range, delivery & pickup service, and flexible rental terms that set your business apart.

Cost Structure

- Direct Costs: Adjust variable costs including Equipment Depreciation, Maintenance & Repairs, Fuel, and Delivery Charges to calculate gross profit margins.

- Administrative Expenses: Include fixed operational costs such as warehouse rent, staff salaries, booking system fees, utilities, and marketing efforts.

- Business Expenses: Account for overheads like insurance, loan interest, equipment leasing, license renewals, and professional service fees.

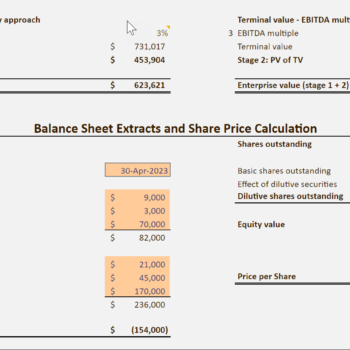

Profitability Analysis

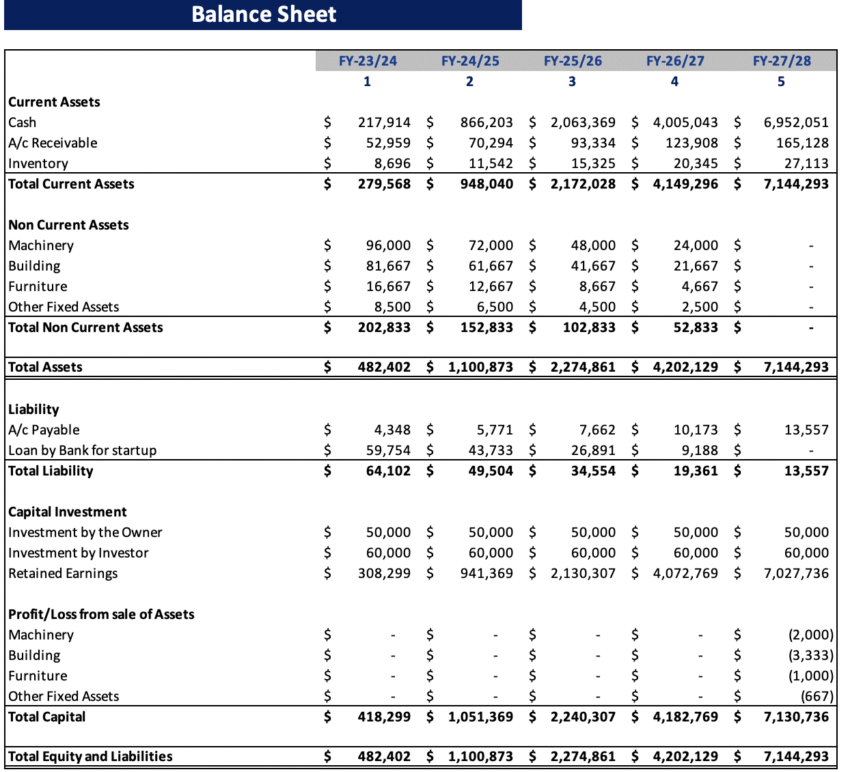

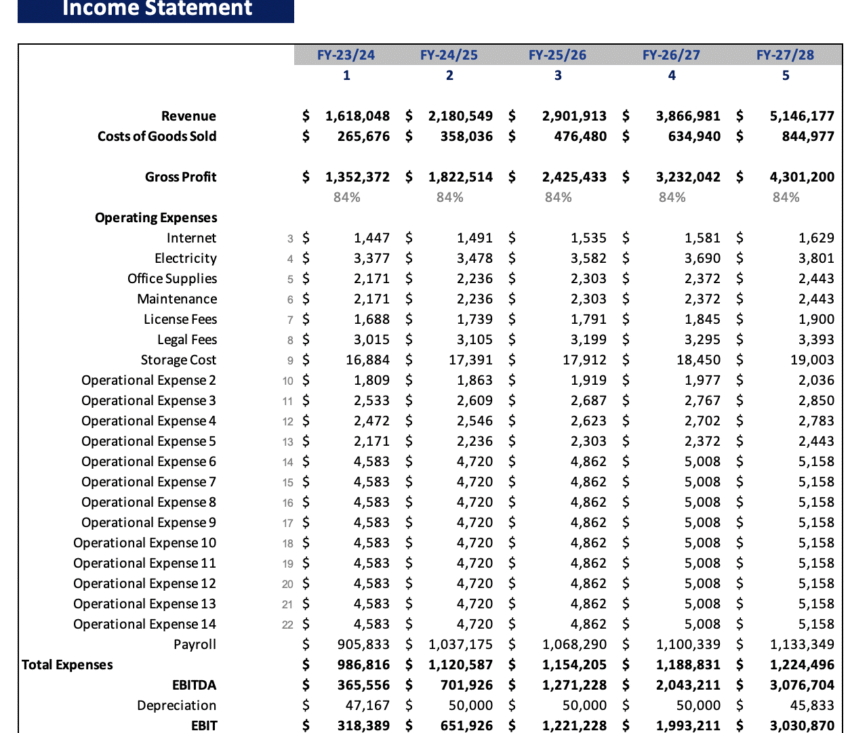

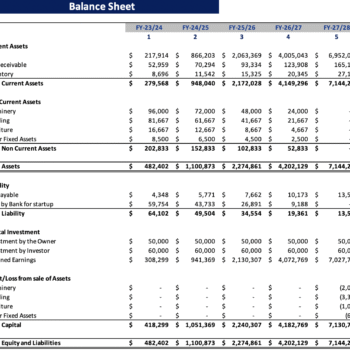

- Profit and Loss Statement: Track income, expenses, and profit over 5 years.

- Gross Margin & Net Profit: Get to know what is the performance of the Industrial based on gross and net profit.

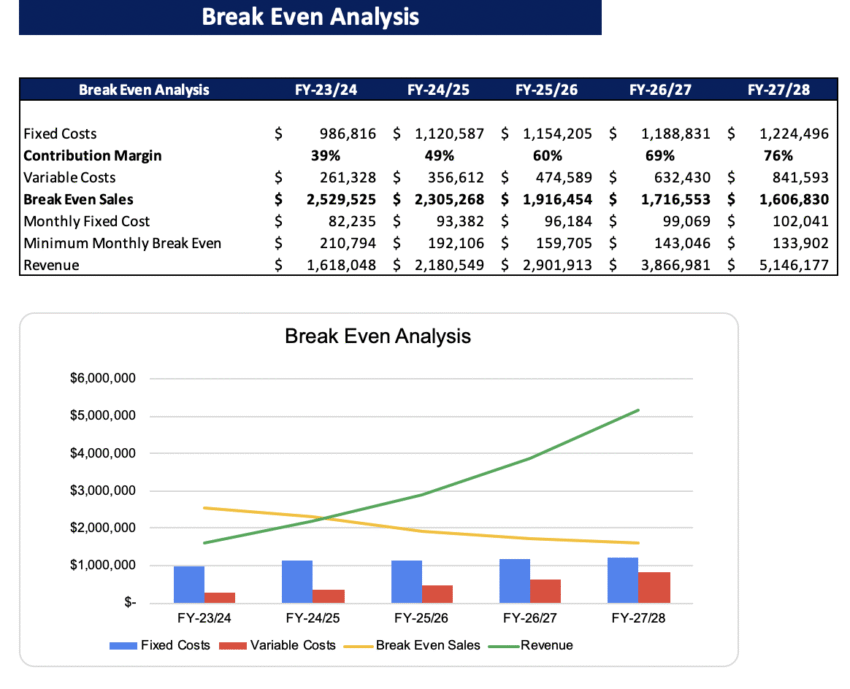

- Break-Even Analysis: Determine the number of Customers needed to cover costs and achieve profitability.

Cash Flow Management

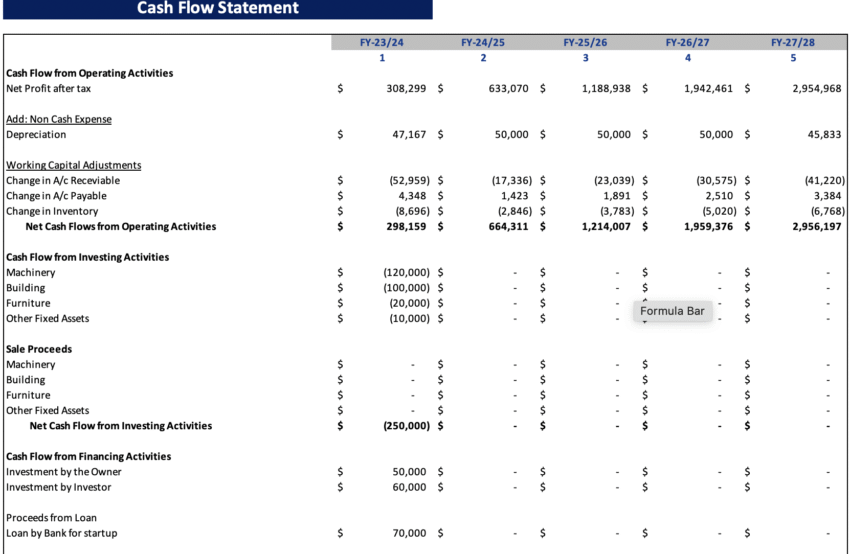

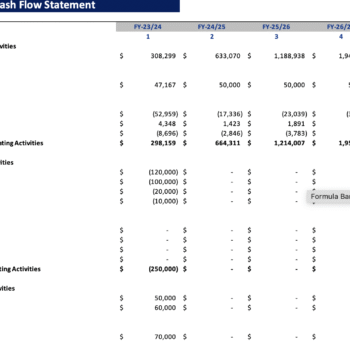

- Cash Flow Statement: Track money flowing in and out of your business.

- Financial Position: Ensure adequate working capital for seamless operations.

- Investment Scheduling: Plan accordingly the cashflow to make your investment decisions for a smoother flow of operations.

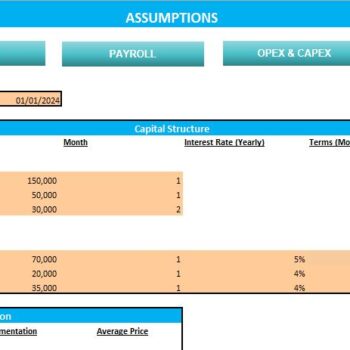

Financial Forecasting & Scenario Analysis

- 5-Year Financial Plan: Develop long term projections for revenue, expenses, and profitability.

- Market Conditions & Trends: Adjust financial forecasts based on industry changes and customer behavior.

- Best-Case, Base-Case, and Worst-Case Scenarios: Evaluate different financial outcomes and prepare accordingly.

Key Performance Indicators (KPIs)

- Customer Segments & Revenue Breakdown: Monitor revenue from different categories such as any equipment.

- Financial Statements: Access dynamic financial statements including income statement, cash flow statement, and balance sheet for performance insights and decision-making.

Investor Readiness & Business Strategy

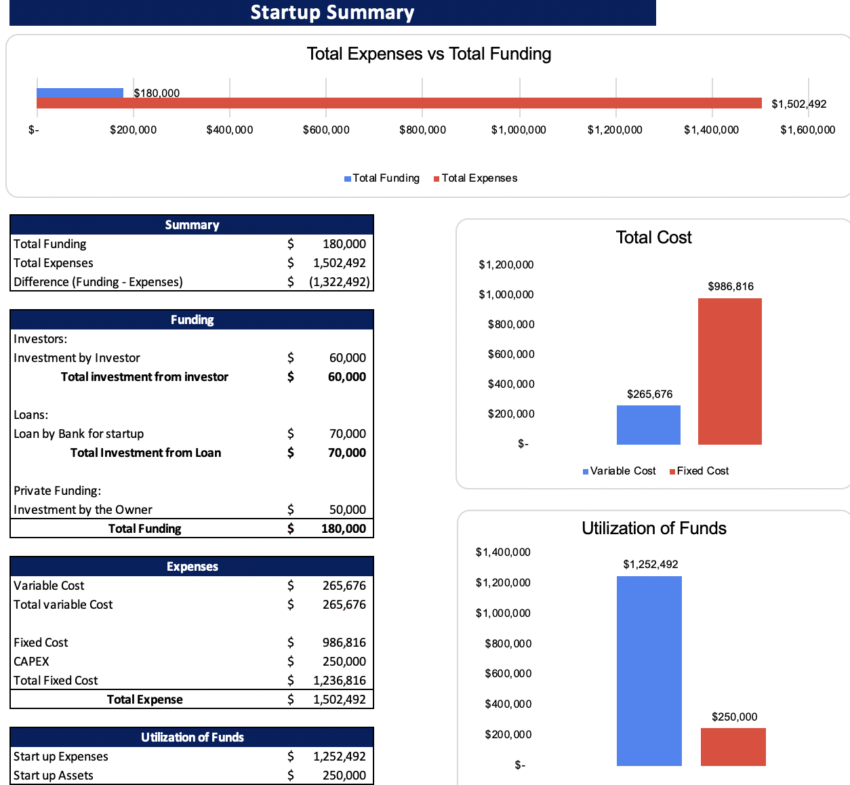

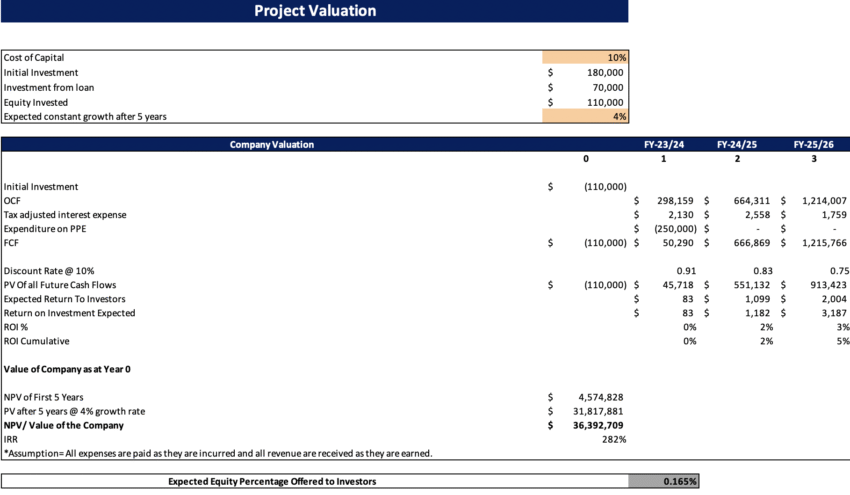

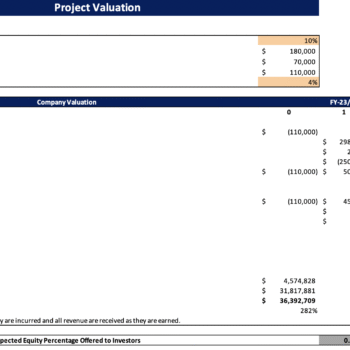

- Attract Potential Investors: Present a professional financial plan to secure funding.

- Strategic Planning: Align business objectives with financial projections for long term success.

- Cost Analysis & Optimization: Better understand which costs can be minimized and which one have to most impact on profitability.

Key Benefits of Using This Model

- Better Financial Planning: Gain a clear understanding of your business’s financial feasibility.

- Optimized Operations: Enhance cost analysis and resource allocation.

- Risk Mitigation: Plan ahead for financial uncertainties and avoid cash shortages.

- Customizable Tool: Adapt the model to fit different business needs.

- Scalability: Suitable for both small startups and established agencies.

FAQ’s

-

What types of equipment can this model be used for?

The model works for construction tools, party supplies, medical devices, electronics, or any asset-based rental business. -

Can I customize rental rates and duration?

Yes, the model allows full customization of rental prices, durations, and equipment availability. -

Does it track utilization and idle time?

Absolutely. The model includes rotation rates, availability, and usage tracking for performance analysis. -

Are maintenance and depreciation included in costs?

Yes, you can input maintenance frequency, repair costs, and equipment depreciation for accurate profit estimation.

Terms of Use:

Oak Business Consultant and our range of products, including this financial model template, are not endorsed by or officially connected to any specific software or platform unless explicitly stated. Your purchase allows you a single license for personal or business use, exclusive to your individual or company needs. Redistribution, resale, or sharing of the files and templates is strictly prohibited. Please direct others to our shop if you find our financial model valuable and wish to recommend it.

Note:

Our product is a digital Excel file. Due to the nature of digital products, we cannot offer returns or exchanges. We encourage you to address any queries or seek clarification before finalizing your purchase.

Need More Help?

Email us at info@staging.oakbusinessconsultant.com to get a customized Rental Equipment Excel Financial Model Projection Template.

Walk-Through Video of Rental Equipment Excel Financial Model

The following video will give you an overview of the different components of the financial model and will help you understand how it works.

1 review for Rental Equipment Excel Financial Model

Add a review

You must be logged in to post a review.

Jim –

This financial model incorporates some great financial features that helped me evaluate my business’s future growth.