Insurance Agency Business Plan Template

Original price was: $350.$210Current price is: $210.

Unveiling a meticulously crafted Insurance Agency Business Plan Template to propel your agency toward unprecedented success. This comprehensive guide intertwines practical insights with strategic directives, providing a robust framework to navigate every facet of your business journey. From shaping your executive summary to forming detailed financial models, this template is forged to illuminate your path in the competitive insurance market, ensuring every step you take is grounded in strategy and actionable insight.

Frequently Bought Together

- Description

- Reviews (0)

Description

Turn your Insurance Agency Vision into Reality with Our Complete Business Plan Template

The insurance industry remains one of the most reliable sectors in terms of long-term profitability, customer retention, and growth opportunities. Whether you are launching a new insurance agency or expanding an existing one, having a structured Insurance Agency Business Plan Template is the key to building a sustainable and scalable business.

This template serves as a complete blueprint—outlining your company’s Executive Summary, market analysis, competitive analysis, marketing plan, operational plan, financial plan, and Risk Management strategies. It’s designed to help entrepreneurs, independent agents, and established insurance providers craft a professional and investor-ready plan.

How This Template Will Help You

- Provides a step-by-step roadmap for starting and scaling your insurance agency.

- Assists in preparing professional documentation for bank loans, investors, or funding requests.

- Helps you conduct accurate market research to identify your target market, market segments, and market trends.

- Offers structured guidance for building a strong Management Team and customer service model.

- Delivers pre-built frameworks for financial projections, financial statements, break-even analysis, and Activity Ratios such as Return on Equity and Net Profit Margin.

- Includes a clear marketing plan with actionable sales strategies, customer acquisition tactics, and digital marketing approaches.

Key Components

The Insurance Agency Business Plan Template is divided into four main parts. Each part is broken down into sections with actionable insights.

1. Core Business Foundation

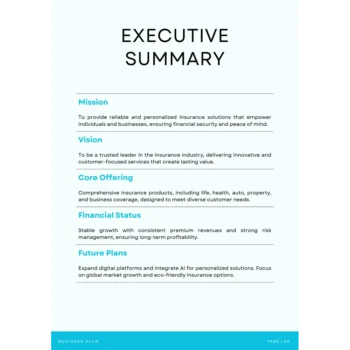

Executive Summary

- Presents a clear, professional snapshot of the entire plan.

- Outlines your Company Overview, mission, vision, target market, and funding request.

- Designed for quick readability by investors, banks, or insurance carriers.

- Should highlight your unique value proposition and expected Net Profit Margin.

Business Description

- Introduces your agency concept, whether it’s life insurance, property insurance, personal insurance, or health and casualty policies.

- Defines your insurance products and insurance services for individuals and businesses.

- Positions your business against existing insurance companies through strategic market positioning.

- Includes your insurance management system for handling insurance claims and policy tracking.

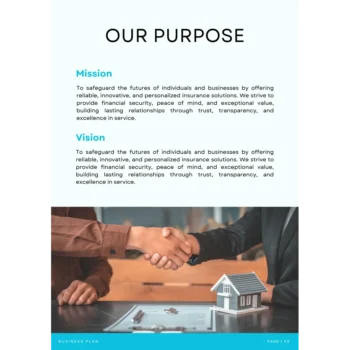

Mission and Vision

- Mission Statement: Explains the purpose of your agency, with emphasis on customer service, Risk Management, and long-term client trust.

- Vision Statement: Describes future growth goals, market share expansion, and reputation-building strategies.

- Both statements should be concise, inspiring, and aligned with industry analysis.

2. Market Intelligence

Industry Analysis

- Identifies key market trends in Life, Health, Property and Casualty insurance.

- Reviews growth rates in insurance carriers and emerging independent agents.

- Analyzes how digital tools, AI, and online insurance management systems are reshaping client expectations.

- Evaluates regulations and licensing requirements for insurance providers.

Market Analysis

- Defines your target market by segmenting individuals, families, and businesses.

- Identifies market segments such as personal insurance, corporate insurance, and niche products.

- Provides a market share estimate and highlights competitive gaps.

- Includes customer insights based on market research and local demographics.

- Outlines geographic opportunities for expansion into new regions or underserved areas.

3. Competitive Strategy

Competitor Analysis

- Lists direct competitors (insurance companies, local agencies) and indirect competitors (banks, online platforms).

- Reviews their insurance policies, pricing models, and customer acquisition methods.

- Includes a checklist for evaluating competitors:

- Products offered (life, property, casualty)

- Marketing strategies and marketing approaches

- Customer service quality

- Financial projections and stability

- Claims settlement efficiency

Competitive Advantage

- Clearly defines what makes your agency unique—whether it’s faster insurance claims, tailored personal insurance, or superior customer service.

- Provides action steps for building advantage:

- Specialization in niche insurance products

- Strong relationships with insurance carriers

- A user-friendly insurance management system

- Affordable yet profitable insurance policies

- Transparent communication and support

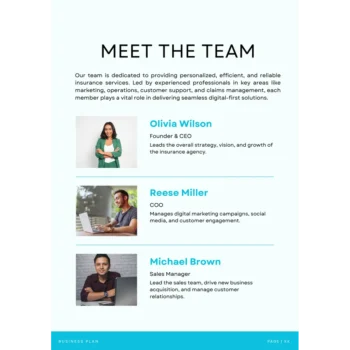

- Strengths: Experienced Management Team, wide product range, strong relationships with insurance providers.

- Weaknesses: Limited brand recognition in early years, dependency on bank loans or external funding.

- Opportunities: Expanding demand for life insurance, property insurance, and personal insurance.

- Threats: Shifting market trends, competitive analysis data, and regulatory risks.

4. Execution Framework

Products and Services

- Offers multiple insurance products:

- Life insurance

- Property insurance

- Personal insurance

- Health and casualty coverage

- Describes add-on services such as Risk Management consulting, insurance claims assistance, and custom policy bundling.

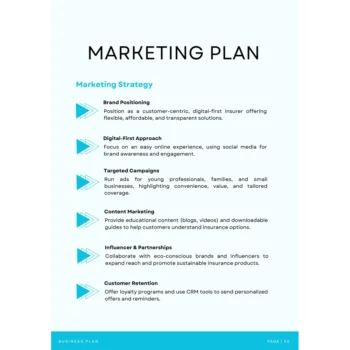

Marketing Plan

The template includes a structured marketing plan covering both traditional and digital marketing approaches:

- Brand positioning: Define how the agency will be perceived in the market.

- Customer acquisition: Strategies for building trust and gaining referrals.

- Retention programs: Loyalty rewards, regular policy reviews, dedicated customer service.

- Digital channels: Social media ads, Google Ads, email campaigns.

- Offline marketing strategies: Local seminars, sponsorships, community engagement.

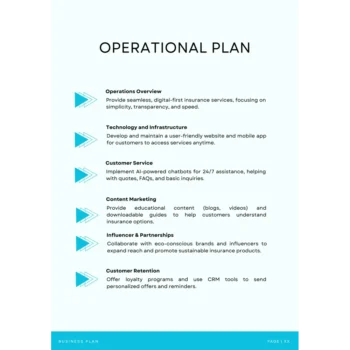

Operational Plan

- Day-to-day agency management framework.

- Includes:

- Staff roles, training, and customer service protocols.

- Partnerships with insurance carriers.

- Workflow through an insurance management system.

- Risk Management and compliance procedures.

- Checklist for Operational Plan:

- Staffing chart

- Claims handling process

- Licensing documentation

- Accounts Payable Turnover and Accounts Receivable Turnover monitoring

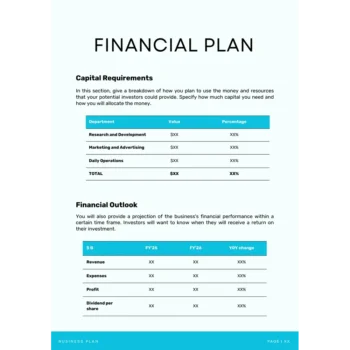

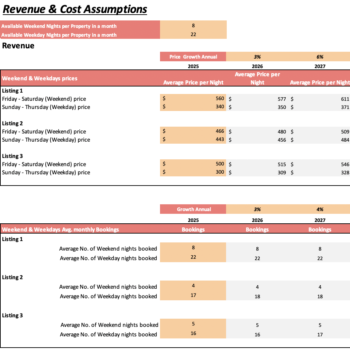

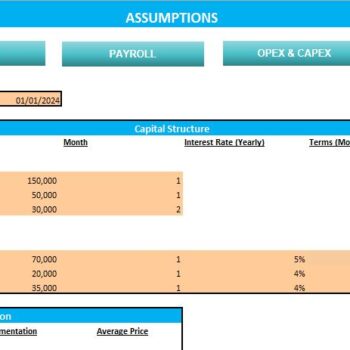

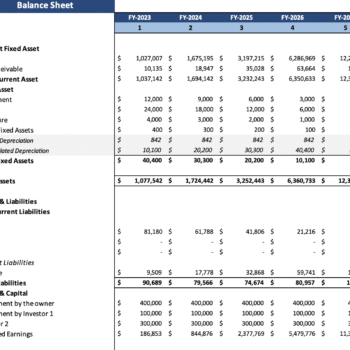

Financial Plan

- Outlines your financial statements, financial projections, and funding request.

- Includes:

- Break-even analysis

- Net Profit Margin calculations

- Return on Equity forecasts

- Total Asset Turnover performance

- Net Working Capital planning

- Provides ratios and performance benchmarks for monitoring:

- Activity Ratios (efficiency in asset use)

- Liquidity (short-term stability)

- Profitability (ROI and growth)

- Helps present a professional case for bank loans or investor funding.

Frequently Asked Questions (FAQs)

1. What is an Insurance Agency Business Plan Template?

It’s a structured document that outlines your Company Overview, market analysis, sales strategy, Operational Plan, and Financial Plan for building a successful insurance agency.

2. Who should use this template?

Independent agents, new entrepreneurs, and established insurance providers aiming to expand, secure bank loans, or attract investors can benefit from this plan.

3. Can this template be used to apply for funding?

Yes, it includes a full financial plan, funding request section, financial statements, and break-even analysis required by lenders and investors.

4. Does the template include financial ratios?

Yes, it provides essential ratios like Net Profit Margin, Return on Equity, Accounts Receivable Turnover, and Total Asset Turnover to evaluate agency performance.

5. How does this plan improve customer acquisition?

By guiding you through proven marketing strategies, sales strategies, and customer service models to build trust and increase long-term customer acquisition.

Be the first to review “Insurance Agency Business Plan Template”

You must be logged in to post a review.

Reviews

There are no reviews yet.