Advanced LBO Financial Model Template

Original price was: $250.$150Current price is: $150.

Evaluate complex Leveraged Buyouts (LBOs) confidently using this Advanced Financial Model Template. It features detailed historical analysis, debt and capital structure setup, dynamic forecasting, comprehensive investor returns (IRR/MOIC), and sensitivity analysis. Essential for private equity, investment banking, and corporate finance professionals.

Frequently Bought Together

- Description

- Reviews (0)

Description

Comprehensive Framework for Leveraged Buyout (LBO) Analysis and Financial Forecasting

Evaluate leveraged buyouts with precision and confidence using this comprehensive Advanced LBO Financial Model Template. Designed for investment analysts, private equity teams, corporate finance professionals, and founders, this template provides a structured framework to build, test, and analyze LBO scenarios. Gain insights into value creation, debt servicing, and investor returns while performing detailed financial forecasting and scenario analysis.

Key Features

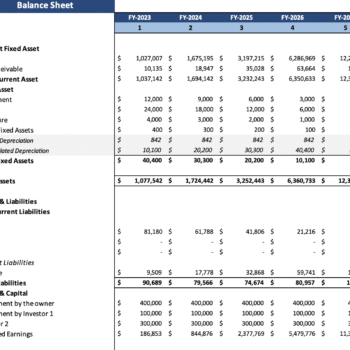

Historical Financials and LBO Readiness Check

Input up to five years of historical financial results, including revenue, costs, cash flow, capital expenditures, and leverage data. A minimum of two years is required to assess LBO readiness. The model evaluates growth trends, cash flow stability, debt capacity, and operational efficiency to determine the company’s suitability for a leveraged buyout.

Transaction Setup and Capital Structure

Build the full deal structure in one place. Define purchase price, funding mix, debt tranches, interest terms, rollover equity, and investor contributions. Establish a clean capital structure to support accurate LBO modeling and scenario planning.

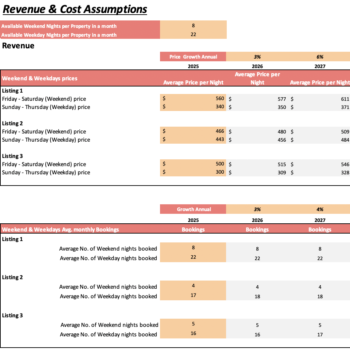

Operational and Financial Forecasts

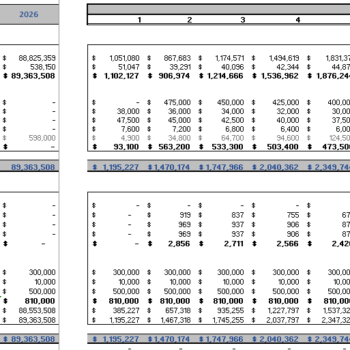

Forecast revenue, operating expenses, capital expenditures, and working capital requirements using flexible input assumptions. All financial statements are linked dynamically, providing a clear view of profitability, cash flow performance, and business sustainability over the projection period.

Detailed Debt Schedule

Track each debt facility in detail, including interest, principal payments, cash sweeps, and remaining balances. Monitor leverage and debt service coverage to evaluate the company’s ability to meet obligations throughout the LBO cycle.

Dividend and Equity Distribution Logic

Calculate dividends and monitor equity distribution for management, sponsors, and new investors. The logic is linked to cash flow and retained earnings, allowing transparent investor-level analysis.

Exit Analysis

Value the business at exit using EBITDA multiples and projected enterprise value. Estimate net debt, equity value, rollover equity, and the cash proceeds received by each investor group.

Returns and Investor Performance

Measure investor returns with MOIC, IRR, total cash returned, dividends received, and retained equity value. This section provides a clear view of each equity holder’s financial performance and payoff from the LBO.

Sensitivity Analysis

Test key assumptions and evaluate risk. Adjust exit EBITDA or other financial drivers to see how enterprise value, equity value, and MOIC change under various scenarios.

Dashboard and Key Ratios

Access a high-level dashboard summarizing the deal. Visualize enterprise value, equity value, debt funding, exit value, MOIC, and IRR. Review charts for debt composition, long-term debt balance trends, profitability metrics, and cash flow performance from operating, investing, and financing activities.

Who Should Use This Template

This Advanced LBO Model is ideal for private equity analysts, investment bankers, corporate finance teams, valuation consultants, and founders preparing for buyout or leveraged acquisition analysis. It supports both simple and complex LBO structures.

Customization

To get a Customized Model, email us at info@oakbusinessconsultant.com or schedule a call with our finance team.

Frequently Asked Questions (FAQs)

1. Do I need advanced financial knowledge to use this model?

No. The model is structured with clear inputs and outputs for intuitive navigation.

2. Can I update assumptions as my analysis evolves?

Yes. Editable inputs automatically update the full model.

3. Does the template calculate investor-level returns?

Yes. It calculates MOIC, IRR, dividends, and retained equity for each investor group.

4. Can I model different deal structures?

Yes. Adjust debt types, capital mix, equity splits, and rollover percentages.

5. Does the model support long-term forecasting?

Yes. Multi-year projections capture the full lifecycle of an LBO, from acquisition through exit.

Terms of Use

Oak Business Consultant and our Soccer Club Excel Financial Model Template are not affiliated with any specific software or platform unless stated otherwise. Your purchase grants you a SINGLE LICENSE FOR PERSONAL OR BUSINESS USE only. Redistribution, resale, or sharing of this template is strictly prohibited. If you find this model useful, please direct others to our store.

Note

This is a digital Excel file. Due to the nature of digital products, returns or exchanges are not available. Please reach out with any questions before purchasing.

Be the first to review “Advanced LBO Financial Model Template”

You must be logged in to post a review.

Reviews

There are no reviews yet.