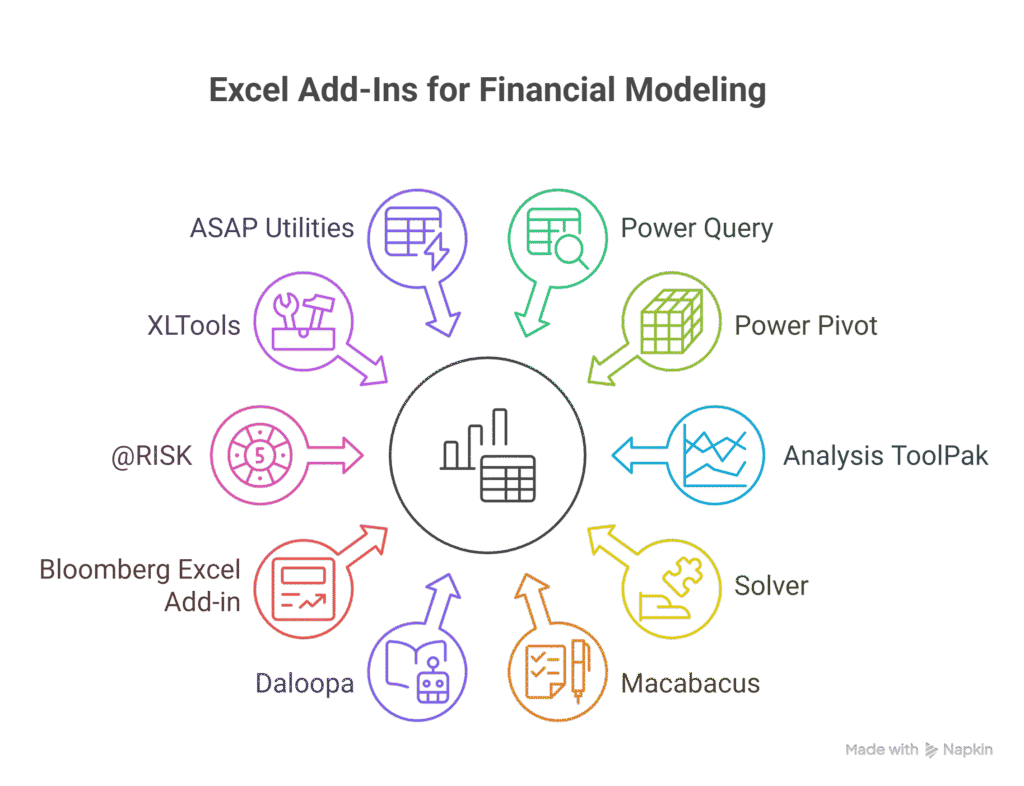

Best Excel Add-Ins for Financial Modeling

10 Best Excel Add-Ins for Financial Modeling: Tools Every Finance Professional Should Use

In the fast-paced world of financial modeling, where financial professionals juggle complex financial data, revenue forecasts, and valuation models, the right Excel add-ins can transform your Excel workbook from a basic spreadsheet into a powerhouse for corporate finance, Monte Carlo simulations, and NPV calculations. Whether you’re building financial models for investment banking, private equity, or SaaS financial projections, these best Excel add-ins for financial modeling streamline data collection, automate nested formulas, and ensure model quality by catching circular reference errors and tab dependencies. In this guide, we’ll dive into the top Excel add-ins that top financial professionals swear by, including free gems like Power Query and Analysis ToolPak, to help you crush financial reports, Gantt charts, and exit modeling with ease.

1. Power Query: The Free Data Wizard for Seamless Financial Data Integration

Power Query tops our list of best Excel add-ins for financial modeling as the ultimate free tool for data collection and transformation in Excel workbooks. Built into Microsoft 365, it lets financial professionals pull financial data from SQL databases, PDFs, or web sources, then clean and merge it without nested formulas or VBA headaches.

| Key Features for Financial Modeling | Benefits | Pricing |

| ETL (Extract, Transform, Load) for market data and profit data | Automates data collection from multiple sources, reducing errors in valuation models | Free with Excel |

| Query folding for large datasets | Handles financial data from ERP systems like SAP, perfect for cost analysis | |

| Integration with Power Pivot for advanced data modeling | Speeds up revenue forecast building in financial models |

Pro tip: Use it to load sample data or add data from cloud storage for instant financial reports.

2. Power Pivot: Build Advanced Data Models Without Breaking a Sweat

For financial modeling that scales, Power Pivot is an essential Excel add-in that turns your Excel workbook into a full-fledged data cube storage engine. It excels at creating relationships between tables for Deep Excel Integration, making it ideal for financial professionals analyzing business systems or financial statements.

| Key Features for Financial Modeling | Benefits | Pricing |

| DAX formulas for complex calculations like NPV calculation | Enables data modelling for Monte Carlo simulations and sensitivity analysis | Free with Excel 2013+ |

| Handles millions of rows of financial data | Powers financial models with Power BI Desktop links for visual aids | |

| PivotTable enhancements for Gantt charts and dashboards | Boosts model quality by spotting circular reference errors early |

As highlighted in reviews, Power Pivot is a game-changer for corporate finance teams building financial models with tab dependencies, pair it with Power Query for end-to-end data collection.

3. Analysis ToolPak: Free Statistical Powerhouse for Risk and Forecasting

The Analysis ToolPak (often called Data Analysis ToolPak) ranks third in our list of Best Excel Add-Ins for Financial Modeling. It is a built-in Excel add-in that’s been a staple for financial modeling since forever, but now, it’s more relevant than ever for Monte Carlo simulations and regression in valuation models. Activate it via the Data tab for instant access to tools that financial professionals use for error detection and scenario planning.

| Key Features for Financial Modeling | Benefits | Pricing |

| Regression, histogram, and Fourier analysis | Essential for risk management in financial models like exit modeling | Free |

| Random number generation for simulations | Supports NPV calculation and cost analysis with statistical rigor | |

| Descriptive stats for profit data | Improves financial reports with quick insights on market data |

It is ranked high for free financial modeling upgrades, especially when integrating with Solver for optimization in corporate finance.

4. Solver: Optimize Your Financial Models Like a Pro

Solver, another free Microsoft gem, is the go-to Excel add-in for financial professionals tackling optimization in financial modeling. Use it to minimize cost of goods sold or maximize revenue forecast under constraints, perfect for LBO models or budget vs. actuals.

| Key Features for Financial Modeling | Benefits | Pricing |

| Linear/non-linear programming | Solves what-if analysis for valuation models and exit modeling | Free |

| Constraint-based scenarios | Enhances Monte Carlo simulations with goal-seeking | |

| Integration with Analysis ToolPak | Automates error mitigation in complex financial data setups |

Many websites list Solver as indispensable for investment banking financial models, especially with keyboard shortcuts for faster workflows.

5. Macabacus: Premium Productivity for Polished Financial Models

For serious financial modeling, Macabacus is a top-ranked Excel add-in that automates formatting, auditing, and PowerPoint integration. Financial professionals in private equity love it for cell-level citations, nested formulas checks, and linking Excel workbooks to presentations.

| Key Features for Financial Modeling | Benefits | Pricing |

| Formula auditing and linking | Catches circular reference errors and tab dependencies in financial models | Starts at $15/user/month |

| Branded templates for financial reports | Streamlines Gantt charts and Sankey diagrams exports | |

| Batch operations for data collection | Boosts model quality for corporate finance teams |

6. Daloopa: AI-Powered Data Extraction for Effortless Financial Modeling

Daloopa leverages AI to pull financial data from PDFs and filings directly into your Excel workbook, making it a favorite for financial professionals updating valuation models in real-time. It’s killer for revenue forecast automation and market data integration.

| Key Features for Financial Modeling | Benefits | Pricing |

| AI extraction from 10-Ks and earnings calls | Eliminates manual tasks in financial models | Free trial; $99/month |

| Real-time updates for profit data | Supports scenario analysis with fresh market segment insights | |

| Error-free imports to Power Pivot | Enhances data modeling for exit modeling |

As per Daloopa’s own benchmarks and Reddit threads, it’s a time-saver for investment banking financial modeling.

7. Bloomberg Excel Add-in: Real-Time Market Data Supercharger

The Bloomberg Excel Add-in is essential for financial modeling involving live market data. Financial professionals in corporate finance use it to stream stock prices, bonds, and economic indicators straight into financial models for accurate NPV calculations and sensitivity analysis.

| Key Features for Financial Modeling | Benefits | Pricing |

| =BDP() functions for real-time pulls | Integrates market data into valuation models seamlessly | Requires Bloomberg Terminal (~$2k/month) |

| Historical data for backtesting | Powers Monte Carlo simulations with live feeds | |

| Custom charting for financial reports | Improves visual aids like Gantt charts |

8. @RISK: Risk Analysis Master for Monte Carlo in Financial Models

@RISK brings pro-level Monte Carlo simulations to Excel add-ins, letting financial professionals model uncertainty in financial modeling for cost analysis or revenue forecast. It’s a must for risk management in volatile market conditions.

| Key Features for Financial Modeling | Benefits | Pricing |

| Probabilistic modeling with distributions | Runs thousands of scenarios for valuation models | $1,295 perpetual license |

| Tornado charts for sensitivity | Identifies key drivers in exit modeling | |

| Integration with Solver | Enhances data collection for robust financial data |

9. XLTools: Affordable All-Rounder for Everyday Financial Modeling

XLTools offers a suite of tools for financial modeling, from merging financial data to building Gantt charts and Sankey diagrams. It’s budget-friendly for financial professionals handling spreadsheet management and error detection.

| Key Features for Financial Modeling | Benefits | Pricing |

| Data merging and cleaning | Simplifies data collection for financial reports | $69/year |

| Calendar and planner tools | Automates Gantt charts for project timelines | |

| Formula generators for nested formulas | Boosts model quality in Excel workbooks |

10. ASAP Utilities: Free Swiss Army Knife for Spreadsheet Efficiency

Rounding out our best Excel add-ins for financial modeling, ASAP Utilities is a free powerhouse for financial professionals think advanced sorting, duplicate removal, and keyboard shortcuts for financial data tasks. It’s perfect for quick error mitigation in financial models.

| Key Features for Financial Modeling | Benefits | Pricing |

| 300+ utilities for cleaning | Tackles manual tasks in data modeling | Free |

| Export to PDF for financial reports | Supports visual aids like Sankey diagrams | |

| Range manager for large Excel workbooks | Improves tab dependencies tracking |

Honorable Mentions: More Gems for Your Financial Modeling Toolkit

- Office Timeline: Pro Gantt charts for project financial modeling ($59/license).

- Engauge Digitizer: Extracts financial data from scanned charts or PDFs (free).

- GPT for Excel and Claude by Anthropic: AI helpers for generating AI formulas in financial models (free tiers).

- Spreadsheet Compare: Built-in for auditing financial models between versions (free).

- OAK by Operis: Model auditing for circular reference errors ($500+/year).

Frequently Asked Questions

What are the best free Excel add-ins for financial modeling?

Power Query, Power Pivot, Analysis ToolPak, Solver, and ASAP Utilities are completely free and used daily by top investment banking and private equity teams.

Is Macabacus worth the price for financial modeling?

Yes. If you build pitch books, LBO models, or investor presentations, Macabacus saves 10–15 hours per deal and pays for itself in one project.

How much time does Power Query actually save?

10–30 hours per model. It automates data pulling, cleaning, and refreshing from PDFs, ERP systems, SQL, and web sources with zero manual copy-paste.

Which add-in is best for Monte Carlo simulations and risk analysis?

@RISK (professional grade). Free alternative: Analysis ToolPak + random number functions.

Power Pivot vs Power BI – which one should I use for modeling?

Use Power Pivot inside Excel for building and running models. Only move to Power BI when you need interactive dashboards for non-Excel users.

I’m new to financial modeling – where do I start with add-ins?

Enable these three today (all free): Power Query → Power Pivot → Analysis ToolPak. You’ll instantly level up from beginner to intermediate.

Conclusion

These Best Excel Add-Ins for Financial Modeling are the difference between spending nights fixing broken links and delivering clean, audit-ready financial models that win deals and raise capital. Start free with Power Query and Power Pivot today, then add the premium tools as you grow.

Ready to stop wrestling with Excel and get investor-grade, error-free models delivered fast?

Our team at Oak Business Consultant builds bulletproof 3-statement, LBO, DCF, and financial models every day, fully loaded with the best add-ins and best practices. Contact us today for a free consultation.