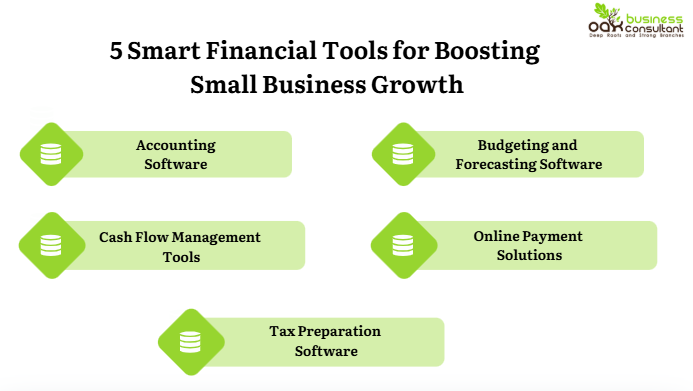

5 Smart Financial Tools for Boosting Small Business Growth

Boost Your Small Business: 5 Smart Financial Tools You Should Use

Running a small business today means dealing with constant financial decisions. These decisions shape your financial stability, influence your cash flow management, and impact your overall financial health. Margins are tight, and every choice matters. That’s why owners need practical financial tools that strengthen day-to-day financial management. The right solutions simplify expense tracking, clarify your numbers, and support smarter investment decisions. They also provide reliable insight through financial analysis tools and interactive calculators that help you anticipate challenges before they surface. In short, modern tools don’t just organize your books. They help you run a more resilient, better-informed business.

1. Accounting Software

Running a small business today means managing a wide range of financial decisions. These choices directly affect your financial stability, long-term financial health, and daily financial management. Owners must monitor cash flow, track financial transactions, and maintain accurate personal finance practices. At the same time, they need to plan for growth.

This is where the right financial tools become essential. Modern platforms combine expense tracking, budget worksheets, online payment solutions, interactive calculators, and financial analysis tools in one place. They help you assess investment decisions, run forecasts, comply with IRS regulations, and prepare for market changes before they happen.

Features like automated reporting, tax preparation integrations, and real-time insights help you make decisions based on facts rather than assumptions. These tools also strengthen your overall financial management by improving planning accuracy, supporting retirement fund projections, and enhancing financial stability oversight.

In the end, smart financial tools do more than organize your information. They give you clearer visibility, stronger controls, and better decision-making at every stage of your business’s growth.

2. Cash Flow Management Tools

Effective cash flow management is one of the most critical drivers of long-term financial stability for any small business. In reality, more companies fail from poor liquidity planning than from weak products or services. Managing incoming and outgoing financial transactions with precision is what keeps operations running smoothly and prevents unnecessary financial stress.

Modern cash flow management tools give owners real-time visibility into how money moves through the business. These platforms integrate with your accounting and financial tools, pulling data from expense tracking, invoices, and budget worksheets to show exactly when cash is coming in, when it’s going out, and where potential pressure points may arise. Many include interactive calculators, scenario modeling, and forecasting capabilities that detect patterns you might otherwise miss.

Imagine receiving an early alert that your business is projected to face a cash shortage in the next sixty days. Instead of reacting at the last minute, you gain the strategic advantage to negotiate new payment terms, adjust inventory orders, delay nonessential spending, or secure short-term financing while rates and conditions are still favorable. This proactive planning strengthens your broader financial management framework and protects the business from operational disruptions.

In essence, advanced cash flow solutions shift you from survival mode to strategic leadership. They help you anticipate challenges, maintain stronger control over liquidity, and support sustainable financial health as your business expands.

3. Budgeting and Forecasting Software

Robust budgeting and forecasting are foundational to sound financial management and long-term financial stability. Budgeting and forecasting software give small businesses the ability to build accurate, data-driven financial models instead of relying on guesswork. These tools integrate seamlessly with accounting systems, pulling real historical data, from cash flow management records to expense tracking and financial transactions to create projections you can actually trust.

With these tools, owners can set realistic financial targets, allocate resources strategically, and evaluate whether operational plans align with broader financial health objectives. The real advantage comes through comprehensive scenario planning. You can model “what-if” situations, such as a 20% drop in sales, the loss of a major client, or the financial impact of opening a new location, without exposing your business to real-world risk. Many platforms also incorporate interactive calculators, financial analysis tools, and multi-year forecasting modules that strengthen decision-making.

In practice, this gives you a form of forecasting visibility that feels like a “crystal ball”, only better, because it’s built on your verified financial data. The result is a more disciplined, proactive approach to managing growth and safeguarding your financial foundation.

4. Online Payment Solutions

Modern online payment solutions for small businesses have become essential financial tools for businesses seeking to improve operational efficiency, customer satisfaction, and overall financial health. These systems allow customers to pay when and how they prefer, credit cards, digital wallets, ACH transfers, or automated recurring payments, removing friction from the purchasing experience. A smoother payment process often leads to higher conversion rates, increased repeat business, and stronger customer loyalty.

From a financial operations standpoint, these platforms automate the organization of financial transactions, consolidate revenue data, and integrate directly with accounting and expense tracking systems. This level of automation eliminates manual errors, strengthens cash flow management, and ensures accurate reporting throughout the year. When tax season arrives, having a complete record, already categorized and reconciled, significantly reduces administrative burden and improves compliance with IRS regulations.

For small businesses aiming to boost efficiency, transparency, and financial oversight, online payment solutions are more than convenience tools, they’re key components of a modern, integrated financial management ecosystem that supports growth and long-term stability.

5. Tax Preparation Software

Effective tax management is a core component of maintaining long-term financial stability and reducing operational risk for small businesses. Modern tax preparation software has transformed what was once a stressful, error-prone process into a streamlined, highly manageable part of your broader financial management strategy.

These solutions are designed to identify deductions, credits, and tax advantages that small business owners commonly overlook. By automating complex calculations and validating entries in real time, the software reduces the likelihood of costly mistakes, IRS penalties, or audit triggers. This level of accuracy not only protects your financial health but also improves your ability to plan around tax obligations as part of your cash flow management efforts.

One of the most valuable features is seamless integration with core financial tools such as accounting platforms, expense tracking systems, and financial analysis tools. This eliminates redundant data entry and ensures that all financial transactions, income records, and deductible expenses are automatically imported and categorized. The result is a cleaner, more reliable tax file and significantly less administrative workload for business owners.

For small businesses aiming to strengthen compliance, improve efficiency, and maintain accurate reporting under IRS regulations, tax preparation software is no longer optional, it’s a critical part of a modern, technology-driven financial ecosystem that supports informed decision-making and long-term growth.

Frequently Asked Questions

How do financial tools improve small-business financial stability?

Financial tools strengthen financial stability by improving cash flow management, organizing financial transactions, and enhancing overall financial health through expense tracking, budgeting, and forecasting.

How does tax preparation software support compliance?

Tax tools streamline reporting by pulling data from income tax returns, W-2 forms, and accounting systems, helping businesses meet IRS regulations and avoid filing errors.

When should business owners consult investment professionals?

Investment professionals help with investment decisions, retirement fund planning, and understanding compound interest when evaluating expansion or recapitalization options.

How do international bodies influence financial conditions?

Groups such as the European Council, DG TRADE, DG INTPA, and the European Investment Bank shape global financial policy and external financial cooperation, affecting markets and export opportunities.

Are there tools that help families plan education costs?

Yes, universities provide online student tools like Degree Audit, Academic History, and Schedule of Classes, while financial tools like the CSS Profile and net cost calculators support scholarship planning.

Why is organizational structure important in financial management?

A clear organizational structure ensures accurate reporting, better control of resources categories, and improved alignment between financial planning and operational priorities.

Conclusion

Strong financial tools give small businesses the clarity and control needed to make smarter decisions and maintain long-term stability. When your accounting, forecasting, cash flow, and tax processes work together, you build a more resilient and efficient operation. Oak Business Consultant can help you get there. We provide expert financial modeling, tax planning, and accounting services designed to strengthen your financial foundation and support sustainable growth. Connect with us today and move your business forward with confidence.